There is Much More to Fiduciary Responsibility Than You Think

By J. Allen | Jul 31, 2018

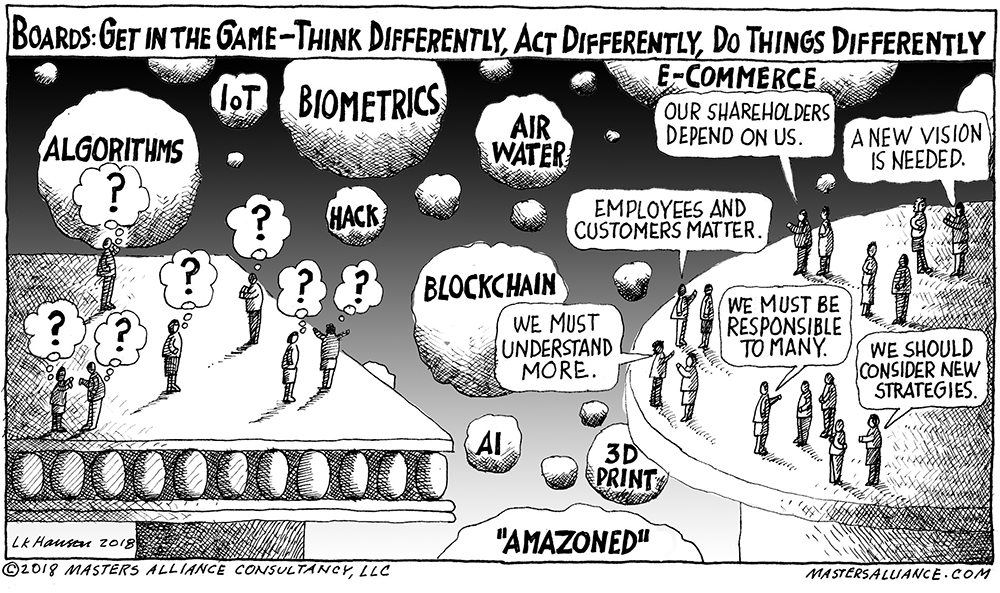

Get in the Game!

Any new board member receives instruction on Fiduciary Responsibility, but if you’ve been in Board Service for very long, we invite you to assess some additional dimensions. Have things gotten better since you arrived? Are you making a difference in customers’ lives, associate energy, supplier engagement, community appreciation, investor confidence and positively impacting markets and other constituents? Are you causing competition to lose sleep? If not, are you blaming the situation on the leadership team? Are you blaming it on the economy? Are you blaming it on the weather? If you are not looking in the mirror, you are missing the point!

When customer confidence and ratings are down the Board should feel the angst of their customers, as well as the leadership team and associates. Board Members should feel a “Fiduciary Compassion” for failing to exceed, let alone meet customer expectations. When suppliers are providing fewer innovations/new ideas and are subject to margins that dampen their enthusiasm for serving your organization and making a difference for your customers – the Board should not only look to leadership as to why but ask themselves what their role was in causing this to happen. And finally, and maybe most importantly, when the organization’s employee turnover rate continues to increase (or conversely is extremely low) what is the real employee dynamic and what is the Board’s role in the situation?

The Board Dilemma

I have served on Boards, worked with Boards, presented to Boards…and am currently on two Boards. I have worked with over 2200 senior executives, internationally and domestically, in the last 30 years as part of my consulting practice. These clients also have Board service listed on their CVs. Many of us have extensive experience with Boards and can recount many, varied experiences with Boards. But it is still a quandary: “How to balance Governance with involvement?” Perhaps the nature of the Board/Organization governance relationship is at fault. With a focus weighted so heavily on fiduciary responsibility, concentrating on financial integrity and risk avoidance, it’s hard to see a path towards enlightenment – and a different way of thinking.

Destroy the Myth of Prestige, Power, Pay and Back-Scratching

Since their inception, the mention of corporate Board of Directors has conjured up images of shiny mahogany power tables, pricey suits, serious faces and deep pockets. These are the circles of influence in communities, individuals looking for a connection and difference for their own companies. In looking at Board Service, there are tomes of information about the Fiduciary Responsibility of Board Members, as in “fiduciary duty to shareholders.” The term is in most every “Board Basics” article written. As a business leader, you know the idea – risk control, financial control, investors’ best interests. And, in some situations, ethics, honesty, principles, values, etc. Also prevalent is a strong focus on a meaningful, viable mission and a robust vision. Of course, all these must be given attention.

The Power of Thinking Differently

Einstein didn’t “invent” the theory of relativity with mathematics. His hypothesis was driven from a curiosity about gravity and acceleration and how the two might work together. It turned out they are actually identical forces with different experiences with different names. He then incorporated mathematics to confirm the theory in sufficient situations for it to be adopted as true. Boards need to demonstrate that same curiosity and also think differently and help their organizations think differently.

The mission then, is to model the thinking dynamics about markets, customer behavior and competitive intentions first, then use the great array of data and statistical methods to support your observations and insight – not the opposite. Insist on both critical thinking and robust analytics to construct a greatly more informed view of the future.

Champions of Thinking and Doing Differently

Generally accepted Board activities are not the stuff that gets a person up early, hardly able to contain the excitement of engaging in the day’s events. Before reading on, let’s be clear – I don’t coach Boards. I do not help them with “teamwork,” “fiduciary stuff,” “organization,” “roles,” or other well-established enhancement tools. If a Board is not primarily dedicated to creating value for all constituents, there may be something wrong with the recruitment/nominating/selection process! If a Board has not signed up to help make a difference in markets, with customers and with associates – resulting in remarkable performance – then why would a potential member be excited about being part of a Board?

It is a Board’s responsibility to help organizations and leaders to think differently, see differently and act differently. It is the Board’s obligation, in terms of fiduciary accountability, to cause the organization and its leaders to use this different thinking to discover unique opportunities for market transformation and competitive advantage – not just describe it with overused words for a popular soundbite, but actually achieve it! Now we’re talking about excitement, engagement, and things that are worthy of getting up and going after. To be champions/promoters of engaging an organization in the exciting benefits of different approaches. To appreciate and reward the power of thinking distinctively while tightly connected to the pay-off of doing differently, is exhilarating. Just try it, continue working it and reap the rewards.

The Board as a Competitive Advantage, Creating Value…. Really!

If you are willing to buy into this idea, then I’d like to bring up a new, potentially groundbreaking idea: A Board of Directors can actually be a competitive advantage. Both the collective Board of Directors as well as the individuals on the Board – the composition, talents and skills can deliver on the commitment of Fiduciary Responsibility with an atypical lens. We’ll talk more about this later – but being open to that premise will help you connect the next few thoughts.

Every Board has an opportunity to be a unique example to others – to set a new standard for performance, sustainability and succession; to be continually improving, preparing others to serve, passing “the torch” and responsibility to incoming members. Boards need to adopt a definable, easy to understand set of values and operating principles in order to ensure that certain fundamentals become basic guidelines for Board behavior, expectations and responsibility. It is not only the organization and its leadership who have a responsibility to create value in many different areas, it is also the Board’s obligation.

The Attraction of Ideas and Different Points of View

Let’s look at a fundamental of performance and an essential ingredient of any successful group effort: an agreed-to, high-impact, make-a-difference, transforming, engaging GOAL. The “secret sauce” of any exciting goal is a connection to a visionary new state for markets, customers, suppliers, communities, associates – and investors. Remember that thing that caused some angst, captured your subconscious, and occasionally woke you up in the middle of the night with some new, exciting thought or solution? Has it been too long, have you forgotten what that is about? If you are currently serving, and this is a vague remembrance, how do you think associates and leaders feel about going to work every day? Do you really think they are excited about creating unique, competitive value, if you are not? Do you think they can be sufficiently incentivized to do so with promotions, rewards and recognition?

Go for the Dynasty, Not the Championship

A caution: a motivating goal, sometimes called a “BHAG” can’t just be a one-time victory – an organization must have some hope of the next challenge, and the one after that. Even Microsoft, with current CEO Satya Nadella, moved from its early goal of “a PC on every desk” to “empowering every person and every organization on the planet to achieve more.” (A pointed observation on May 2018: Jim Kramer pronounced on CNBC that leaders “should not be constrained by the four walls of the spreadsheet – for to do so would be dumb, dumber or suicidal.”)

Help everyone on the team see how they can be significant, somehow making a difference – how they can be the underlying secret sauce for innovation, excellence and personal accomplishment. Go for the Dynasty, Not the Championship.

Partners in Current and Sustainable Success

I like to see Boards intentionally balance their dual roles of governance and advisory duties. As individual members and as a group, Boards should be expected to offer different informed perspectives and views on a great variety of topics – including technical advances, social situations, business dynamics, emerging business concepts, entirely new businesses, etc. My preferred acronym reminder is KEWI (Knowledge Experience, Wisdom and Insight). I see Boards and Organization Leaders uncomfortably balancing the tension between an authority and advisory partnership, between oversight and accountability. Let’s explore another way of thinking about the relationship. Let’s look at success and accountability as two sides of the same coin. Who really holds boards accountable? Shareholders, maybe. Institutional investors, maybe. Vocal agitator groups, maybe.

The usual reporting responsibility of an organization’s leadership to the Board is very valid and greatly necessary, but it is insufficient. New thinking is that the Board is also accountable to the organization and its leadership team. The board and the leadership team jointly share the responsibility, as partners, to learn, think and act together for the benefit of all constituents – different roles and responsibilities, but collaborative allies in the effort.

Although the trusted advisor role is sometimes not wanted or fully utilized by management, it is essential for Boards to successfully foster it as a critical competitive advantage. An earlier suggestion for Board values and operating principles needs to be expanded to include how they are responsible to the leadership team and the organization. These responsibilities need to fully express the Executive Leadership Team’s expectations from the Board, as well as the expectation from the investor community.

A New View of Fiduciary

How far does Fiduciary Responsibility extend? Aside from delivering the highest value to shareholders, what about fiduciary responsibility to other constituents? What does fiduciary responsibility really mean? Let’s look at few common definitions:

- From the Latin fiducia, meaning “trust,” having the power and obligation to act for another under circumstances which require total trust, good faith and honesty.

- Involving trust: “the company has a fiduciary duty to shareholders.”

- A fiduciaryrelationship extends to every possible case in which one side places confidence in the other and such confidence is

- One often in a position of authority who obligates herself or himself to act on behalf of another.

- Essentially, a fiduciaryis a person or organization that owes to another the duties of good faith and trust.

Of course, the shareholders of the organization are a critically important constituency – after all, Board Members represent shareholders and are elected to serve their interests. At the surface, some may think that shareholders simply care about the price per share and the potential upside of the stock’s value. However, even a novice investor understands that the underlying health of the company, its growth strategies, treatment of employees and customer service, etc. are what really drives the metrics reported on a company’s stock profile.

Fiduciary Responsibility to Customers?

Let’s continue with a constituent group, whom without, the organization wouldn’t exist: Customers. You might argue that there’s no room in your role as a Director on the Board to influence the realm of “customer” for the organization. Think again! Board members provide guidance, advice and governance to the leadership team on their strategies and long-range plan – if you don’t see the customer and customer service success metrics powerfully reflected in this plan, then perhaps some dialogue at the Board level is appropriate. Proactively directing the leadership team to consider taking care of the customer may not be a traditional role, but it’s needed. Corporate leaders’ priorities are influenced by the Board – leaders will make serving customers a priority if the Board insists.

Rather than view customers as those “pesky people” who drain your customer service resources and demand low prices, it is a Board Member’s responsibility to connect with what makes customers tick and Directors should insist that innovative solutions be offered to help them solve problems they may not even know they have – and to help customers better serve their customers. As customer driven revenue pays the bills, and actually determines an organization’s viability, isn’t it critical to safeguard customer opportunities to grow and extend their relationship with your organization? Thus, fiduciary responsibility to clients and customers!

Would you rather face the flip-side of proactive customer focus? It may be easier to imagine your Board Member role in Governance when sales are down, market share is down, net income is down, customer ratings are declining – quoting your fiduciary responsibility in crafting your punitive response to these reports. What’s the traditional Board going to do? Point your finger and lay blame on leadership or management? Change leadership “horses,” incentivize differently? React in disappointment, disdain or even anger (when in danger or in doubt, run in circles, scream and shout)?

Consider an alternative scenario when the Board is more in-touch and understands the real business dynamics of the marketplace and the associates who serve it. Good news or bad news on the customer front, Board Directors are also responsible.

Fiduciary Responsibility to Employees?

Let’s move on to another constituency: Employees. What responsibility does a board member have to the organization’s associates? From the warehouse worker all the way to the C-Suite, the organization is comprised of real people who deliver value to the company – they perform in a way that causes customers to come back, pay more, influence others to buy (or in contrast, do the opposite and customers buy somewhere else). While there is no place for over-involved, interfering and overcontrolling Board participation in the day to day business matters of the organization, Boards do need to contribute to a “Fiduciary Partnership” with an organization and its leadership.

Board Members naturally fear crossing over the line – away from “directing” and closer to “managing.” That fear may drive members to a point of detachment, rather than working for the right balance. Further exacerbating this issue is the literal separation between Board Members and employees. In some organizations employees are even instructed to be “seen but not heard” when a Board meeting occurs. In the name of segregation of duties, Board Members are sequestered and not encouraged to walk the halls and meet the heart and soul of the organization. When Leadership addresses the Board about their employee base, they use reports, numbers, charts and statistics. Aside from the Compensation Plans they approve, and the presentations they receive from Leadership on specific strategies, risks and accomplishments – interaction with anyone outside of the C-Suite is limited.

This can lead to isolated, “overly-managed communications” to the Board. It’s a tradition that is well rooted in our corporate culture. However, is there a lost opportunity in this tradition? What if leaders spent energy creating interaction opportunities with their Board rather than actively isolating members from rank and file staff members – going beyond inviting board members to employee town halls to sit in the front row and applaud. If the Board, either as a group or at an individual level, felt that they were more connected with staff, linking faces to a few names, seeing the people behind the numbers – wouldn’t that lead to higher engagement for both groups?

Here’s a good test. If a Board Member can walk through the halls of your organization, and employees don’t recognize them (outside of the fact that they are wearing a suit), it may be time to rethink how engaged they are. Or, if a Board Member is given the opportunity to meet a group of employees in the lunch room, but politely declines, you are seeing the tradition work against you. How can a Board Member feel a responsibility to the entire organization if that relationship is limited to the select, and very few individuals they hear from at their meetings? Are you more afraid of what a Board Member might learn by interacting with line level employees, or that they might dig deep into the day to day operations? Trusting board members to engage with, but not manage staff is key. Help them, prepare them, go with them at first, make connections part of the culture. See what happens, both in the organization and with Board Members.

Again, this does not mean operational interference or over-controlling activities, but it does mean the Board needs to contribute to a “Fiduciary Partnership” with an organization’s leadership.

Other Essential Views

Fiduciary responsibility to communities. Yes, Board oversight and responsibility must include an organization’s relationship with the communities in which it does business – it is the right thing to do and also happens to be good business!

Fiduciary responsibility to develop and prepare Board candidates. To identify, recruit and develop high-potential Board candidates. What are you and your Board doing to ensure the pipeline of future board members meet these criteria and are interested in relating to all of the constituencies mentioned above – not just the shareholders?

Supporters of reality over legacy. A Board’s influence is greatly enhanced as a calm, experienced, encouraging voice – and as intense advocates for clarity of situation implications and future scenario planning. The Board should not tolerate reports of un-anticipated circumstances, nor those who only see surprising problems as un-intended circumstances (without a thought of responsibility for not anticipating a situation). This accountability helps leadership teams and organizations observe more, think more, accomplish more – to anticipate, “see around corners” and be one move ahead of competition.

Your collection of the best, brightest, most talented and experienced must come together as a team – in a partnership of excellence with the management team – to influence customers, surprise markets, engage suppliers, excite associates and benefit communities. Rally around the goal of having more fun and making more money.

Hopefully it is becoming obvious that Boards must walk and chew gum at the same time. It’s time to get in the game. A Board’s “Fiduciary Partnership” is essential to all constituents and the continuing competitive viability of the organization – it is not just management’s fault when things go south, it also the Board’s performance that is questionable.

We Can Help

We provide the tools and experience to help your organization think and compete differently. We’ve helped dozens of our clients implement this new way of thinking and doing.

Masters Alliance is a 30-year strategic management consulting firm that has helped more than 120 client organizations in over 20 industries in 13 countries gain a competitive advantage in their market. We help organizations develop and implement unique business strategies that work – faster than our clients ever thought possible.

We help clients achieve significant performance gains from a breakthrough understanding of their customers, patients, clients and markets.